Warning! Medicare Flex Card Scams

When you deal with healthcare benefits, you might see offers that seem too good. Sadly, Medicare Flex Card Scams are getting more common. They trick seniors with false promises of extra benefits. It’s important to stay smart and watch out for these scams.

Do you know how scammers try to get your personal info or payment details? You’ll want to know the warning signs. As a Medicare user, protecting yourself from fraud is key. Being alert helps you avoid Medicare fraud.

To keep your benefits safe and avoid scams, you need to be careful and know what’s going on. By understanding the dangers and taking steps to protect yourself, you can stay safe from Medicare Flex Card Scams. This way, you can have a secure healthcare experience.

Key Takeaways

- Be cautious of unsolicited offers that seem too good to be true.

- Verify the authenticity of Medicare-related communications.

- Never share personal or payment information with unverified sources.

- Stay informed about the latest Medicare scam alert.

- Take proactive steps to protect against Medicare Flex Card Scams.

The Growing Epidemic of Healthcare Fraud in 2025

In 2025, the healthcare world is facing a big problem. More and more scams are happening, mainly against people on Medicare. Medicare Flex Card scams are a big part of this issue.

These scams use fake insurance and cards to trick seniors. They want seniors to give out personal info or pay money they don’t have to.

What Legitimate Medicare Flex Cards Actually Offer

Real Medicare Flex Cards are part of some Medicare plans. They offer dental, vision, and hearing help. These cards help pay for things not covered by regular Medicare.

These cards can really help seniors. They cover things like dental care, eye exams, and hearing aids. Knowing what these cards do is key to spotting scams.

Why Seniors Have Become Prime Targets for Scammers

Seniors are easy targets for scammers. They might not know much about technology. Scammers use tricks like fake websites and emails to get their info.

Also, seniors who are lonely are more likely to fall for scams. They might not have friends to check if something seems off with their Medicare.

Understanding Medicare Flex Card Scams and How They Operate

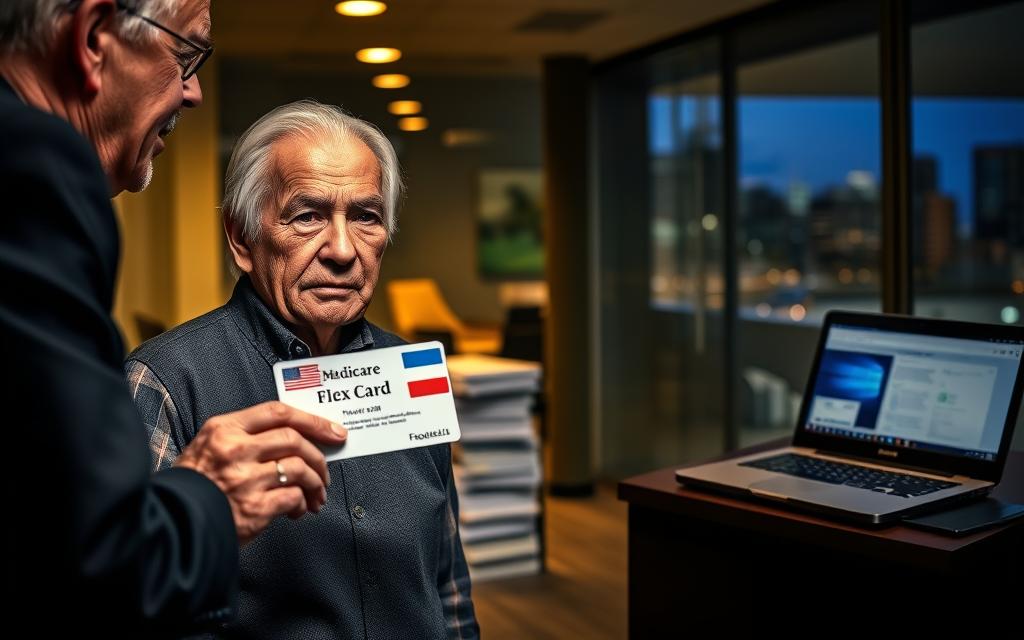

Scammers trick seniors into giving out personal info or paying for fake services. They use fake ads, calls, and emails that look real. It’s key to know the warning signs.

Deceptive Tactics That Fool Even Careful Seniors

Scammers use many tricks to fool seniors. These include:

- Fake Medicare reps calling or emailing for personal info.

- Phony websites that look like real Medicare sites.

- Social media ads that promise extra Medicare benefits.

Medicare Flex Card scam tactics often make you think you must act fast. They say you’ll lose benefits if you don’t.

The Warning Signs That Should Raise Immediate Concern

Knowing the warning signs of medicare scams helps you stay safe. These signs are:

| Warning Sign | Description |

|---|---|

| Unsolicited Requests | Getting calls, emails, or messages asking for personal or financial info without asking. |

| Too Good to Be True | Offers that seem too good, like unusually high benefits or rewards. |

| Urgency | Being told to act fast, making you feel rushed. |

Real Victims Share Their Heartbreaking Stories

Listening to victim stories is a powerful reminder. Many seniors have lost money and felt sad because of these scams.

One senior lost $10,000. She was called by someone claiming to be from Medicare. They asked for her Social Security number to “verify” her benefits.

By knowing how scams work and the warning signs, you can keep yourself and your loved ones safe.

The Psychological Manipulation Behind Medicare Fraud

It’s important to know how Medicare fraud works. Scammers use tricks to fool and take advantage of seniors. They play on their fears and weaknesses.

How Scammers Exploit Fear About Healthcare Costs

Scammers use fear about healthcare costs to trick people. Seniors worry about medical bills and how they’ll pay for them. Scammers offer fake help, saying they have special Medicare benefits or financial aid.

For example, a scammer might call, saying they’re from Medicare. They claim you can get free healthcare. They might ask for your personal info or money to get this “benefit.”

The Urgency Trap: Why “Act Now” Offers Are Dangerous

Scammers try to make seniors act fast. They say offers are only good for a short time or that you’ll miss out if you don’t act now. This is to stop seniors from thinking too much and to make them act without checking things out.

Be careful of any offer that wants you to act quickly. Real organizations, like Medicare, won’t rush you. Always check things out before you decide.

Building Trust Through False Authority and Credentials

Scammers pretend to be important people or make up fake credentials. They might say they’re from Medicare or a government agency. They use fake names, titles, and logos to look real. They want to make seniors trust them so they can trick them.

To stay safe, always check who they are. Call the real organization yourself, not the person calling you.

Digital Medicare Scam Techniques to Watch For

The rise of digital communication has brought new Medicare scams. Scammers use technology to target Medicare recipients. They send phishing campaigns, fake websites, and social media scams promising extra benefits.

Sophisticated Phishing Campaigns Targeting Medicare Recipients

Phishing scams are getting smarter. They trick even the most careful people. These scams look like they’re from Medicare or trusted sources. They ask for your personal info or login details.

Be cautious of emails or messages with:

- Urgent requests to update your information

- Spelling and grammar mistakes

- Links to unfamiliar websites

Fake Medicare Websites That Steal Your Information

Scammers make fake websites that look like Medicare’s. They promise extra benefits or quick claim processing. These sites steal your personal and financial info.

| Red Flags | Legitimate Medicare Sites | Fake Medicare Sites |

|---|---|---|

| URL | medicare.gov | medicare-login.com |

| Contact Info | Clear contact information | No contact info or fake info |

| Promises | No unrealistic promises | Promises of extra benefits |

Social Media Scams Promising “Enhanced” Medicare Benefits

Social media scams promise “enhanced” Medicare benefits. They use fake accounts or posts that seem real. These scams come from Medicare or related groups.

Be wary of social media posts that:

- Promise unusually high benefits or rewards

- Ask you to click on suspicious links

- Request your personal or financial information

To stay safe, check info through official Medicare channels. Be careful of messages or posts that promise extra benefits without asking.

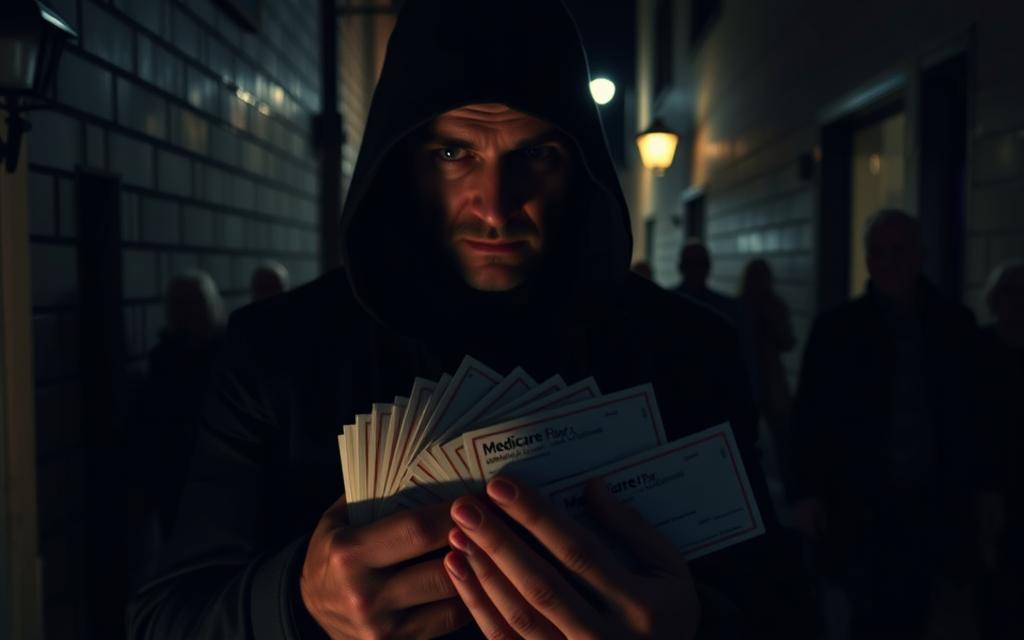

Offline Medicare Flex Card Scams to Avoid

Be careful with unsolicited messages to avoid Medicare Flex Card scams. Scammers are getting smarter, targeting seniors in many ways.

These scams can happen through mail, phone, or in person. Knowing these tactics helps keep your money and info safe.

Mail Fraud: Counterfeit Medicare Communications

Scammers send fake Medicare letters or documents by mail. They look real but ask for your personal info or money for services they don’t offer.

To stay safe, check any Medicare mail by calling Medicare directly. Use a trusted phone number or website.

Phone Scams: When “Medicare Representatives” Call

Scammers also call, saying they’re from Medicare. They might ask for your info or money. Real Medicare reps won’t ask for your info over the phone without checking first.

If you get such a call, hang up. Then, tell Medicare or the FTC about it.

In-Person Fraud: Door-to-Door Medicare Imposters

Scammers might visit your home, saying they’re from Medicare. They might want money or your personal info.

To keep safe, don’t let strangers in without checking who they are. Always call Medicare to see if they’re real.

Knowing about these scams and checking who you talk to can help you avoid them. This way, you can keep your money and info safe.

Protecting Your Identity from Medicare Card Theft

Today, keeping your Medicare info safe is key. Losing your Medicare card can hurt your money and personal info.

Essential Security Measures for Your Medicare Information

To keep your Medicare safe, use strong security steps. Always keep your Medicare card in a safe place. Don’t carry it unless you must.

Also, review your Medicare statements often for odd things.

| Security Measure | Description | Benefit |

|---|---|---|

| Secure Storage | Keep your Medicare card in a locked cabinet or a safe. | Prevents unauthorized access. |

| Regular Review | Check your Medicare statements for suspicious activity. | Early detection of fraud. |

| Shredding Documents | Shred any documents containing your Medicare information. | Protects against dumpster diving fraudsters. |

Setting Up Fraud Alerts and Benefit Monitoring

Setting up fraud alerts and watching your Medicare can catch fraud early. You can set up alerts through your Medicare online account or call Medicare. Watching your benefits helps you spot odd changes or activities.

Digital Security Practices Every Senior Should Implement

In today’s world, keeping your online life safe is just as important as your physical stuff. Use strong, unique passwords for your online accounts. Also, think about using two-factor authentication. Keep your devices and software up to date to fight off cyber threats.

By taking these steps, setting up fraud alerts, and staying safe online, you can lower the chance of losing your Medicare card and identity fraud.

Steps to Take If You’ve Been Targeted by Medicare Flex Card Scams

Being targeted by a Medicare Flex Card scam is scary. But, there are steps you can take to protect yourself and lessen any harm.

Immediate Actions to Minimize Damage

If you think you’ve been targeted, act fast. Don’t talk to the scammers or give them your personal or financial info. Then, call your bank or credit card company to tell them what happened and get their advice on keeping your accounts safe.

Next, change your passwords for all important accounts. This includes those linked to Medicare or your money. Also, turn on two-factor authentication if you can. This adds more security.

How to Report Medicare Fraud to Authorities

Telling the authorities about Medicare fraud is key to stopping others from getting scammed. You can report the scam to the Federal Trade Commission (FTC) online or by phone.

Also, contact Medicare to report the fraud. You can call their fraud hotline or use their website to file a complaint. Don’t forget to tell your state’s Attorney General’s office too.

Resources for Medicare Scam Victims

If you’ve fallen victim to Medicare Flex Card scams, help is out there. The FTC has tips on their website for those affected by identity theft and scams.

You can also contact your local senior center or community group for help. Many places offer support and advice for seniors who have been scammed.

By following these steps, you can reduce the harm and help catch the scammers. Remember, you’re not alone. There are people and resources ready to help you through this.

Distinguishing Between Legitimate Medicare Benefits and Fraudulent Offers

As a Medicare beneficiary, knowing the difference is key. Scammers are getting smarter. So, it’s important to check if any Medicare messages are real.

Official Medicare Communication Channels You Can Trust

Real Medicare messages come from official places. You can count on:

- Mail from Medicare or your Medicare Advantage plan

- The official Medicare website (https://www.medicare.gov)

- Phone calls from Medicare or your plan (you can verify the caller’s identity by calling back the official Medicare number)

Always be cautious of unsolicited calls, emails, or messages claiming to be from Medicare. Scammers often use these methods to gain your trust.

Verifying Medicare Benefits Through Proper Channels

To check your Medicare benefits, do the following:

- Look at your Medicare Summary Notice (MSN) or Explanation of Benefits (EOB) from your Medicare Advantage plan

- Log in to your account on the official Medicare website

- Contact your Medicare Advantage plan or Medicare directly using their official contact information

| Verification Method | Description | Trusted Source |

|---|---|---|

| Medicare Summary Notice (MSN) | Regularly mailed document showing your Medicare claims | Medicare |

| Official Medicare Website | Secure online portal for managing your Medicare information | https://www.medicare.gov |

| Direct Contact | Calling Medicare or your plan directly using official numbers | Medicare or your Medicare Advantage plan |

Questions to Ask When Approached About Medicare Flex Cards

When someone talks about Medicare Flex Cards, ask these questions:

- What is the purpose of the Medicare Flex Card?

- How does it relate to my existing Medicare benefits?

- Can you provide official documentation or a letter from Medicare explaining the card?

- How do I activate or use the card?

Being informed and cautious is your best defense against fraudulent offers. Always verify information through official communication channels before taking any action.

Conclusion: Empowering Yourself Against Medicare Scams in 2025

As we get closer to 2025, it’s key to stay alert and learn about Medicare scams. Knowing how scammers work helps you keep your money and personal info safe. This way, you and your family can avoid losing money and keep your identity safe.

Teaching seniors about scams is very important. You can protect your info by being careful with offers or requests for personal details. This is your first line of defense against scams.

To stay safe in 2025, keep up with the latest scam tricks. Always check if messages from Medicare are real. This helps you avoid scams and keeps your money safe for the future.

Resources:

Is the Medicare Flex Card Legitimate?